According to Microsoft founder Bill Gates, cryptocurrencies are killing people in a “quite direct way.”

He was referring that Digital currency (bitcoin) is used to purchase pharmaceuticals such as fentanyl, a synthetic opioid besides Anonymity is the primary characteristic of cryptocurrencies. Government’s can track down money laundering, tax evasion and terrorist financing if it’s through global payment system. Crypto accounts are not the same as it’s not possible to track transaction done through crypto so we can’t usually name a beneficiary. They are more vulnerable to security issues for instance, if we keep our crypto on a physical device at home and only a few friends know our key – a sort of password that grants access to a crypto wallet – one of those so-called friends could walk into our house and steal our crypto just as easily as they could steal our great-diamond grandmother’s earrings. Alternatively, if we did not share the keys with anyone, our crypto will be lost forever.

Cryptocurrency What is it?

A cryptocurrency e.g. Bitcoin is a digital currency in which transactions are validated or verified and records are kept by a decentralized system rather than a centralized system utilizing encryption. In specific, Bitcoin is a peer-to-peer payment system controlled by cryptography. The process of Bitcoin mining is used to create Bitcoins . Miners are enormous computer networks that collect transactions and enlarge them so that they can be used to buy or sell goods or services online.

Pros and Cons of Cryptocurrency:

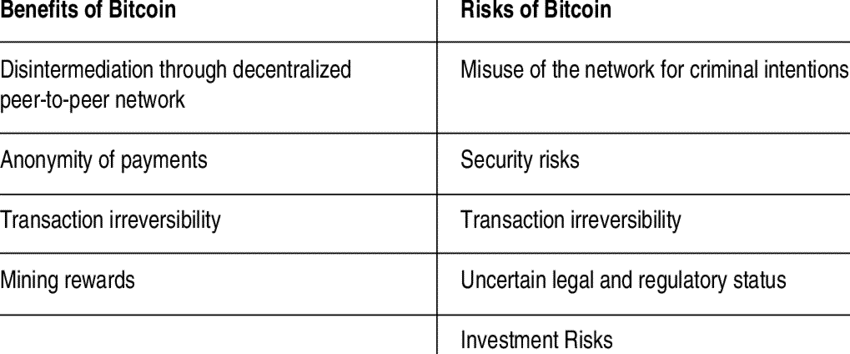

There are various good elements of Bitcoin and ways the cryptocurrency might help digital investors prosper financially.

Pros:

- Bitcoin transaction fee is often lower than traditional currencies because of their lack of physical presence. They are processed for minimal costs, allowing the network to be open to all users and merchants to accept payments.

- The anonymity of Bitcoin allows user to protect their privacy. The user is not known by name, and transactions shift Bitcoin ownership from one address to another. Users can have multiple addresses for each transaction.

- Bitcoin is unaffected by a local bank or governmental laws. This is a beneficial component of Bitcoin since some countries with high levels of inflation or capital control can use it to prevent economic turmoil (instability). Authorities cannot freeze assets, and high levels of engagement cannot attract government notice.

- The benefits of Bitcoin have enabled ordinary people to become millionaires. It gave people a chance to become wealthy. Grant Sabatier described how he spent nearly five years investing in the stock market and working 80 hours per week to achieve his first million. But he did it in just one year with Bitcoin.

Cons:

The disadvantages, or reasons why individuals do not invest, are due to extreme volatility.

- This is due to the market’s high volatility. After all, trades have an impact on the value of Bitcoin.

- Theft is another important issue. Theft occurs when an authorized user makes an unlawful transfer and someone hacks into their private access key, which is the “ticket” that allows the user to spend Bitcoins.

- In February 2014, cyber attackers stole all Bitcoins worth $2.7 million from the Silk Road 2 website.

- On the “dark web,” Bitcoin is also used for international crime. The network of illegal websites enables drug sales and money laundering. The US government shut down “Liberty Reserve,” an anonymous virtual money transfer service famous for $55 million transactions to hide unlawful operations, in May 2013.

How to assure safety of your crypto wallets?

Crypto wallets can be digital, managed via an app or website, or physical, such as a thumb drive.

- HOT WALLETS: These are utilized for cryptocurrency trading and purchases. They have the advantage of being free and convenient, but they are less secure because they are continually linked to the internet.

- COLD WALLETS: These are used to store cryptocurrency for a longer period. Consider it like placing your cryptocurrency in a freezer.

The hot wallet functions like a checking account, with money going in and out, but the cold wallet is more like a savings account, with money stored for an extended period. You can have both at the same time.

In summary, the storage options range from the least secure to the safest are as follows:

Centralized cryptocurrency exchanges (like Coin base):

- Login Instructions: Password and username

- Recover or backup account data: Verify your identity twice and/or contact customer support.

Hot wallets (also known as mobile wallets) that are un-hosted (not on a centralized platform)

- Login Instructions: Key to a private wallet

- Recover or backup account data: You’ll need a secret seed phrase of 12 or 24 words.

Cold storage (also known as hardware wallet) that serves as a digital safe via USB drive

- Login Instructions: Key to a private wallet

- Recover or backup account data: You’ll need a secret seed phrase of 12 or 24 words

The up and down in cryptocurrencies:

At the start of 2010, a single bitcoin worth was about $0.01. It was hovering (floating) close to $70,000 at its high in November of last year, representing a nearly 700 million percent rise in value in just over a decade. According to estimates from the price-tracking website CoinMarketCap, recently the value of Bitcoin dropped by $200 billion in 24 hours, wiping out $200 billion from the cryptocurrency market.

Why do cryptocurrency prices drop?

One of the issues that contribute to the current financial market instability is the absence of control of cryptocurrency and its continuous excessive volatility. President Joe Biden signed an executive order in March to investigate cryptocurrency and its excessive price fluctuations in the hopes of protecting American consumers, investors, and businesses from the possible “systemic financial hazards presented by digital assets.’’

Following this, the Federal Reserve remarked in a recent report on financial stability in the United States that one of the (many) underlying risks with the financial market is the lack of clarity around “stable coins,” which are supposed to be digital assets that remain stable but have shown fluctuation similar to the rest of the digital market in the past week. According to the Fed’s research, if there is a “run” on digital currencies or even a lack of trust in them, the entire digital economy might collapse.

Why do people commit suicide in the aftermath of the cryptocurrency crash?

Several suicides have been recorded as a result of bitcoin losses, highlighting the long-standing link between financial troubles and mental health. Globally, one person dies by suicide every 40 seconds, according to World Health Statistics. This results in about 800,000 deaths due to suicide every year. Suicide is the second leading cause of death in the world for those aged between 15 and 24 years, after accidents. Most suicides are the result of a combination of causes, including mental health issues, and numerous suicides have recently been reported as a result of cryptocurrency losses.

There are some examples of it.

- Last year, a couple in China committed suicide after the husband lost $3 million on his bitcoin investment. According to The Business Standard, the wife’s parents owned $500,000 of the total. Before jumping from a bridge, the husband stabbed and killed his daughter. The husband was apprehended and charged with the murders of his wife and daughter. Similarly, Times Now News claimed that a bitcoin trader from India killed his wife and two children before committing himself in October last year as a result of large losses and increasing debt from bitcoin investments.

- In March of this year, a person from Turkey murdered his two children and wife before committing suicide owing to losses from bitcoin investments. A month later, the New Indian Express claimed that a temporary public sector bank employee in India drank rat poison and died after losing over $13,600 in bitcoin investments owing to a ‘technical lapse. ‘Similarly, according to a Crypto News report, the same month (May), an investor from South Korea committed suicide after losing more than $180,000 in unknown crypto assets.

Suicides linked to cryptocurrency and financial difficulties

This is not the first time that cryptocurrency-related suicides have made headlines. After the cryptocurrency market fell in August of last year, there was a comparable spike in crypto-related suicides. Suicide is increasingly being motivated by financial difficulties. Losses resulting from faulty investments, whether related to bitcoin or not, are tough to deal with.

Researchers discovered that a sudden substantial loss of wealth can impact mental health. Cryptocurrencies have developed as a popular financial asset, particularly for millennia (youngsters) ls. While cryptocurrency prices have always been volatile, they have reached new highs and lows in the last year. These bull and bear runs have generated the enormous potential for wealth accumulation while also causing excruciating losses, leading to suicides.

If there is one thing to learn about Bitcoin, it is that the market is entirely open to the investor. Nobody knows whether their investment selections will make or break them. Bitcoin has the potential to become the next significant form of currency. In a world where the internet meets all of our requirements, we must be aware of the potential of Bitcoin and how it may affect our investments. Bitcoin is a game-changer that is here to stay, for better or worse. So, my question is, will you invest in Bitcoin today?